Here's a quick guide to creating a small business budget:

- Gather financial records (bank statements, tax returns, sales data)

- Choose a budgeting method (spreadsheet or software)

- Set realistic financial goals

- Calculate your income and expenses

- Create a profit and loss statement

- Build an emergency fund

- Review and adjust regularly

Key components of a small business budget:

| Component | Description |

|---|---|

| Revenue | Expected income |

| Fixed costs | Regular expenses (rent, salaries) |

| Variable costs | Expenses that change with activity |

| One-time expenses | Unexpected or infrequent costs |

| Cash flow | Money moving in and out |

| Profit | What's left after expenses |

Why budget? It helps control costs, set goals, make informed decisions, and prepare for the future.

Remember: Your budget is a living document. Check it monthly and adjust as needed.

What is a Small Business Budget?

A small business budget is your financial roadmap. It's a plan that shows your income and expenses, helping you manage money and make smart choices.

Defining a Business Budget

Think of a business budget as your company's financial GPS. It shows where your money's coming from and where it's going. It:

- Maps out income and expenses

- Helps set financial goals

- Guides spending decisions

- Prepares for financial ups and downs

Main Parts of a Small Business Budget

A solid budget has these key pieces:

| Component | Description |

|---|---|

| Estimated revenue | Expected earnings |

| Fixed costs | Regular expenses (rent, salaries) |

| Variable costs | Expenses that change with business activity |

| One-time expenses | Unexpected or infrequent costs |

| Cash flow | Money moving in and out |

| Profit | What's left after expenses |

Why Budgets Help Businesses

Budgets aren't just about numbers. They're tools that can transform your business. Here's how:

1. Control costs

A budget helps you spot overspending. You might notice you're spending too much on office supplies and cut back.

2. Set realistic goals

Look at past performance to set achievable targets. If sales grew 10% last year, you might aim for 15% this year.

3. Make data-driven decisions

Use real numbers to guide choices. If your budget shows extra cash, you might invest in new equipment or hire staff.

4. Prepare for the future

Plan for good and bad times. Set aside money for slow periods or unexpected expenses.

5. Attract investors

A well-planned budget shows investors you're serious. It proves you know your numbers and have a clear financial plan.

Getting Ready to Make Your Budget

Before you start crunching numbers, let's set the stage for your small business budget. A little prep work goes a long way.

Collecting Your Money Info

First things first: gather these financial records:

- Bank and credit card statements

- Tax returns

- Payroll records

- Accounts receivable and payable

- Sales records

- Expense receipts

With these in hand, you'll have a clear view of your business's financial health.

Picking a Budget Method

You've got two main choices:

1. Manual (spreadsheets)

Good old Excel or Google Sheets. You're in control, it's free, and you can customize to your heart's content. But it's time-consuming and mistakes can sneak in.

2. Software

Tools like QuickBooks, Xero, or FreshBooks. They're faster and do the math for you. But you'll need to learn how to use them, and they cost money.

For most small businesses, software is the way to go. It's easier and more accurate in the long run.

Setting Doable Money Goals

Your budget needs realistic targets. Here's how to set them:

- Look at your past performance

- Think about what's happening in your market

- Consider your growth plans

- Be cautious with income estimates

- Add a little cushion to your expense estimates

It's smart to aim for goals you can actually hit. As the saying goes, "Under-promise and over-deliver."

"A third of all small businesses exceeded their budgets within the past fiscal year, indicating a significant risk of cash flow challenges."

Don't let this be you. Set practical goals based on what your business can really spend and save.

Step-by-Step: Making Your Budget

Let's break down how to create a small business budget.

Looking at Your Income

First, list all your income sources:

- Product sales

- Service fees

- Investments

- Royalties

Check your last 12 months of data for trends. A winter clothing company might make 70% of its yearly income from October to February.

"Examine your revenue: Look at your existing business and find all your revenue sources. Add them up to see how much money comes in monthly."

Adding Up Fixed Costs

Next, tally your fixed costs. These don't change based on your output:

| Fixed Cost | Example Amount |

|---|---|

| Rent | $2,000/month |

| Salaries | $10,000/month |

| Insurance | $500/month |

| Loan payments | $1,000/month |

Can you cut these costs? Maybe negotiate with suppliers or find cheaper office space?

Figuring Out Changing Costs

Variable costs change with your business activity:

- Raw materials

- Shipping fees

- Hourly wages

- Credit card fees

Keep a close eye on these. If you're a bakery, your flour and sugar costs will change based on how many cakes you bake.

Setting Up an Emergency Fund

Save for unexpected expenses. Aim for 3-6 months of operating costs. This fund helps during slow periods or sudden expenses.

Making a Profit and Loss Statement

A Profit and Loss (P&L) statement shows your financial health:

1. Total Revenue

2. Minus Cost of Goods Sold

3. Equals Gross Profit

4. Minus Operating Expenses

5. Equals Net Profit (or Loss)

Update your P&L monthly or quarterly to stay on top of your finances.

Finishing Your Budget

Put it all together in one document. Make sure your income covers expenses, with some left for profit and growth. Set realistic goals based on past performance and market trends.

Using and Checking Your Budget

Regular Budget Check-ups

Check your budget against real results often. Do this monthly or quarterly. It helps you catch problems early.

Take a bakery, for example. They might check flour costs weekly. If prices jump 20%, they can act fast.

Changing Your Budget as Needed

Update your budget when things change. It keeps it useful.

| When to Update | Why |

|---|---|

| Revenue changes | Plan for growth or cuts |

| New costs appear | Keep spending in check |

| Market shifts | Adapt to new conditions |

Using Your Budget to Make Choices

Your budget guides decisions. It shows where to spend or save.

- Hiring? Check if you can afford someone new.

- Need equipment? See if it fits your plan.

- Marketing? Decide how much to spend.

"Comparing actual results to your budget helps you quickly assess your business performance."

Budget use tips:

- Set clear money goals

- Track progress often

- Get your team involved

- Use software to make it easier

sbb-itb-0fc0b25

Common Budget Problems for Small Businesses

Small business owners often mess up their budgeting. Here's what goes wrong and how to fix it:

Overestimating Income

Many small businesses think they'll make more than they actually do. This leads to overspending and cash crunches.

In 2020, nearly half of small businesses with under 10 employees didn't even make a budget. That's a recipe for spending more than you earn.

To avoid this:

- Look at past sales to guess future income

- Think about market trends and the economy

- Plan for the worst

Missing Costs

It's easy to forget expenses, which throws off your whole budget.

| Expense | Why It Matters |

|---|---|

| Office supplies | Small stuff adds up |

| Software subscriptions | Recurring charges sneak up on you |

| Taxes | Can eat 30-40% of revenue |

| Seasonal changes | Affect cash flow |

Pro tip: Check old bank statements to catch everything.

Ignoring Seasons

Busy and slow seasons can wreck your budget. Izzy, a Maine designer, knows this well:

"I can make $20,000 in busy months but only $3,000 in slow ones. Budgeting software helps me stay afloat year-round."

To handle seasonality:

- Save during good times for the bad

- Tweak your budget monthly

- Try seasonal promos to boost slow periods

Not Updating Your Budget

A stale budget is useless. During the pandemic, 66% of businesses had to change their budgets due to money troubles.

To keep your budget fresh:

- Review it monthly

- Compare what you planned to what happened

- Adjust as your business changes

Tools to Help with Small Business Budgets

Creating a budget for your small business doesn't have to be a pain. Here are some tools to make it easier:

Budget Software Options

Here's a quick look at some popular budget software:

| Software | Starting Price | Key Features |

|---|---|---|

| QuickBooks Online | $35/month | Profit/loss budgets, performance tracking |

| Xero | $15/month | Unlimited users, 1000+ app integrations |

| Zoho Books | Free (<$50k annual revenue) | Automated workflows, project tracking |

| PlanGuru | $99/month | 20+ forecasting methods, 10-year forecasts |

| Float | $69/month | 3-year cash flow forecasts, QB/Xero integration |

These tools help you track income and expenses, create budgets, and generate reports. QuickBooks Online, for example, lets you compare your actual performance against your budget predictions.

Free Budget Templates

Not ready to pay? Try these free options:

- QuickBooks: Free budget template (PDF and Excel)

- Microsoft Excel and Google Sheets: Customizable templates

These templates usually cover monthly income, expenses, and cash flow balance.

"I started with a free Excel template. It helped me understand my cash flow and spot areas where I was overspending." - Small business owner, Portland, OR

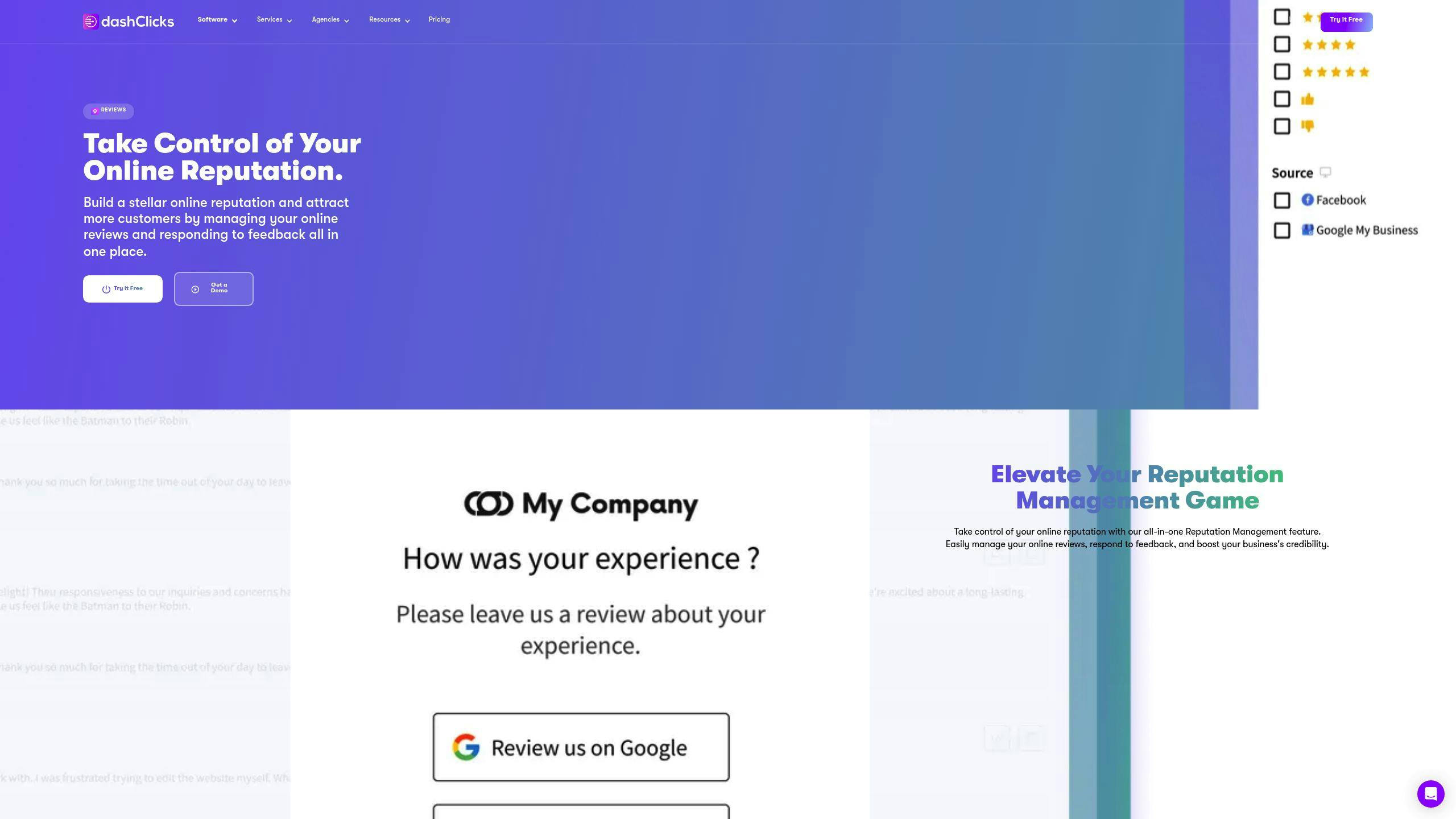

ReputationDash

ReputationDash isn't a budgeting tool, but it can impact your bottom line by managing your online reputation. A good reputation can lead to more customers, higher sales, and lower marketing costs.

"Our 5-star reviews increased by 30%, leading to a 15% boost in walk-in customers. This allowed us to allocate less money to advertising in our budget." - Bakery owner, Austin, TX

Choose the tool that fits your needs and budget. Remember, the right tool can save you time and help you make smarter financial decisions.

Wrap-up

Creating a small business budget isn't a one-and-done deal. It's an ongoing process that needs your attention. Here's a quick rundown:

- Gather financial info

- Pick a budgeting method

- Set realistic goals

- Analyze income and expenses

- Create a profit and loss statement

- Finalize your budget

Your budget should evolve with your business. To keep it on track:

- Check it monthly (or more)

- Be ready to adjust

- Save for emergencies

- Use budgeting tools

"A budget is simply a guide to assist you in making better spending decisions." - Steve Jordan, Senior Manager at Wipfli

FAQs

How do I create a simple business budget?

Creating a simple business budget isn't rocket science. Here's what you need to do:

- Keep your business and personal money separate

- Set up a rainy day fund

- List where your money's coming from

- Figure out your fixed costs

- Calculate your variable costs

- Make a profit/loss statement

This basic setup helps you keep tabs on what's coming in and going out. It's like a financial GPS for your business.

How to create a budget as an entrepreneur?

As an entrepreneur, your budget needs to be as flexible as you are. Here's how to do it:

- Set a target budget (dream big, but be realistic)

- List your startup costs (what you need to get off the ground)

- Pin down your fixed costs (the bills that don't change)

- Estimate your variable costs (the ones that fluctuate)

- Calculate your monthly revenue (what you expect to bring in)

- Review and adjust your total costs (keep it lean and mean)

This approach helps you plan for the initial cash burn and project your future money flow.

How do I create a small business budget spreadsheet?

Creating a budget spreadsheet doesn't have to be a headache. Here's the process:

- Gather all your financial data (the more, the better)

- Use a template or create your own (no need to reinvent the wheel)

- Input your revenue figures (be honest with yourself)

- Subtract your fixed costs (the unavoidable expenses)

- Account for your variable costs (the ones that change)

- Plan regular budget reviews (keep it up to date)

A spreadsheet makes it easy to tweak and track your budget as your business grows.

How to create a budget for a small business?

For a small business budget that covers all the bases:

1. Analyze your costs

Take a hard look at where your money's going.

2. Negotiate with suppliers

Don't be shy about asking for better deals.

3. Estimate your revenue

Be realistic about what you can bring in.

4. Calculate your gross profit margin

This tells you how much you're really making.

5. Project your cash flow

Plan for when money comes in and goes out.

6. Factor in seasonal trends

Most businesses have ups and downs throughout the year.

7. Set spending goals

Decide where you want to invest your money.

8. Combine all elements

Put it all together for a complete picture.

This approach helps you create a budget that covers all your bases and keeps your business on track.